You could be receiving up to 43.5% of spend back as cash!

"We didn't even know that the R&D Tax Incentive was available. We went through the form and pre-qualified. They connected us with a R&D grant specialist who took over and completed the claim for us. $73k in cash back thus far, which has allowed our company to continually improve our product development. Thanks to Grant Buddy, we got approved and funded."

"I used Grant Buddy and can a-test to their service. I received $49k back that I didn't know I was entitled to!"

"It was very quick & easy. I filled out the form questionnaire and pre-qualified. The someone rang me within 30 minutes. Our company was approved for the R&D grant within 2 weeks. I would use this service again.

As featured on:

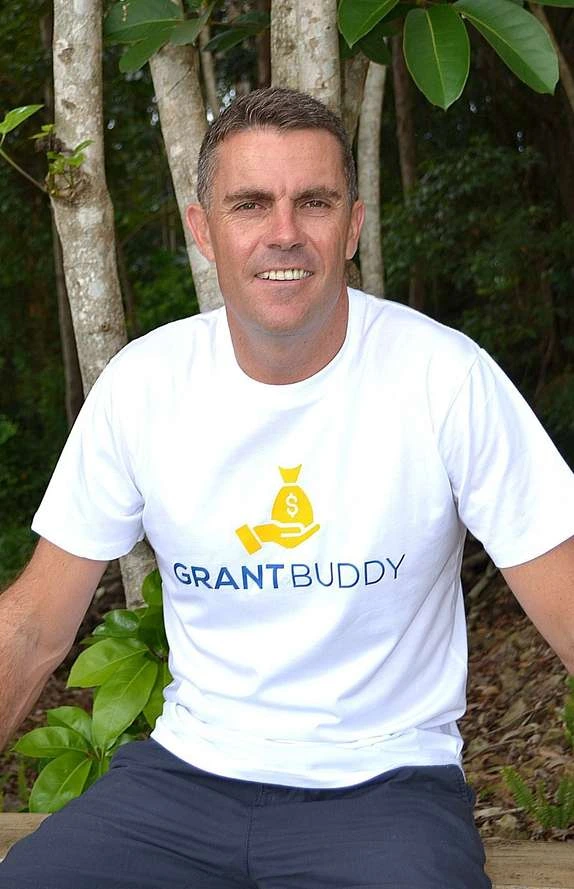

Hi, I'm Chris Stanton, based in the sunny Gold Coast..

After being in business for over 19 years and having a degree in Industrial Design, I understand that cashflow is paramount when it comes to Research, Development and Innovation.

Whether you are developing a new product, device, software, AI, technology, process, system or material…cash flow is king!

After speaking to many Aussie companies, most of them have the same issues when it comes to research and development:

BUT the most concerning issue that I found…

Not enough Australian companies are aware of the Research & Development Tax Incentive.

In fact, there are approx. 12,000 + Australian companies that are eligible, but don’t claim

R&D grant funding annually.

I wanted to fix this, so in 2021 we created Grant Buddy, in order to raise awareness of the program to help Aussie businesses innovate and fuel growth.

The Grant Buddy platform connects/matches you to an R&D Consultant based on your R&D activity & Industry.

My vision is to make sure that every Australian company that’s eligible for R&D Grant Funding - receives it and maximises it.

Happy Innovating 😊

R&D Grant Benefit Examples*

The Research & Development Tax Incentive (RDTI) is an Australian Government programme that provides tax offsets for expenditure on eligible R&D activities. The aim is to encourage businesses to support the development of new products, processes and services, encourage innovation and increase competitiveness and productivity. It provides cash back, or in some instances a tax saving of up to 43.5% based on your eligible R&D expenditure.

This can make it more attractive for businesses and entrepreneurs to invest in R&D, as it can help to reduce the financial burden of these activities, and allow you to access critical cashflow your business needs to keep the R&D cogs turning.

Our simple 12 step questionnaire will gather all the info we need to identify if your company is eligible.

Speak to our grant specialists to find out if you qualify for the R&D Tax Incentive, or if you need to provide some more information.

Our grant specialists will manage the entire application process, saving you valuable time & resources.

Once you’ve been approved, our grant specialists will communicate with you on the timeline of your cashback payment or tax offset amount.

We make it easy for every day Australian companies to find out if they are eligible for the Research & Development Tax Incentive Grant!

If eligible, we connect you with a highly skilled and experienced R&D Grant specialist, so you can benefit from:

Simply enter your details into our advanced AI quiz and we’ll do all the hard work for you!

We connect you with Government Grant specialists, who search and advise the available pool of billions of dollars in Federal, State and Local government grants, private grants and other funds - all aligned with your business objectives.

We ask your details & if you qualify we help connect you with a business grant expert who can

help you.

The expert will then give you a call to obtain more info from you & give you an idea of

whether or not you could qualify for a grant.

Our partners consist of over 30 grant experts Australia wide. These experts are from various backgrounds but are all certified to assist with grants for businesses.

This depends on information flow from the client and also the lodgement/ delivery particulars of the service/product.

We handle the entire process for you!

Save time, money & stress

We are experts at doing this for 30+ years

Increase your chances of getting the grant.